Greenway's Markets in a Minute | Higher Mortgage Rates Expected in 2018

|

| For the Week Ending February 23, 2018 |

|

Please enjoy this quick update on what happened this week in the housing and financial markets. |

|

|

|

|

|

Minutes from the Fed's last FOMC meeting point to more policy rate hikes ahead. Officials have seen an increase in economic growth and an uptick in inflation. |

|

The Fed doesn't control mortgage rates, yet rates are influenced by the Fed's actions. As the Fed raises policy rates this year, mortgage rates will likely follow. |

|

Jobless claims hit a near 45-year low last week, pointing to strong job growth in February. A strong labor market supports the growing economy. |

|

|

|

Existing home sales fell unexpectedly in January, possibly due to tight inventory and rising mortgage rates. Home supply has declined for 32 straight months. |

|

New housing starts were up though, to a 1-yr high of 1.326 million in January. Building permits soared to their highest level since 2007. |

|

While builders are busy creating new homes, condos are lacking. Condos are 7% of the multifamily market (down from an average of 22% from 1985-2003). |

|

Rate movements and volatility are based on published, aggregate national averages and measured from the previous to the most recent midweek daily reporting period. These rate trends can differ from our own and are subject to change at any time. |

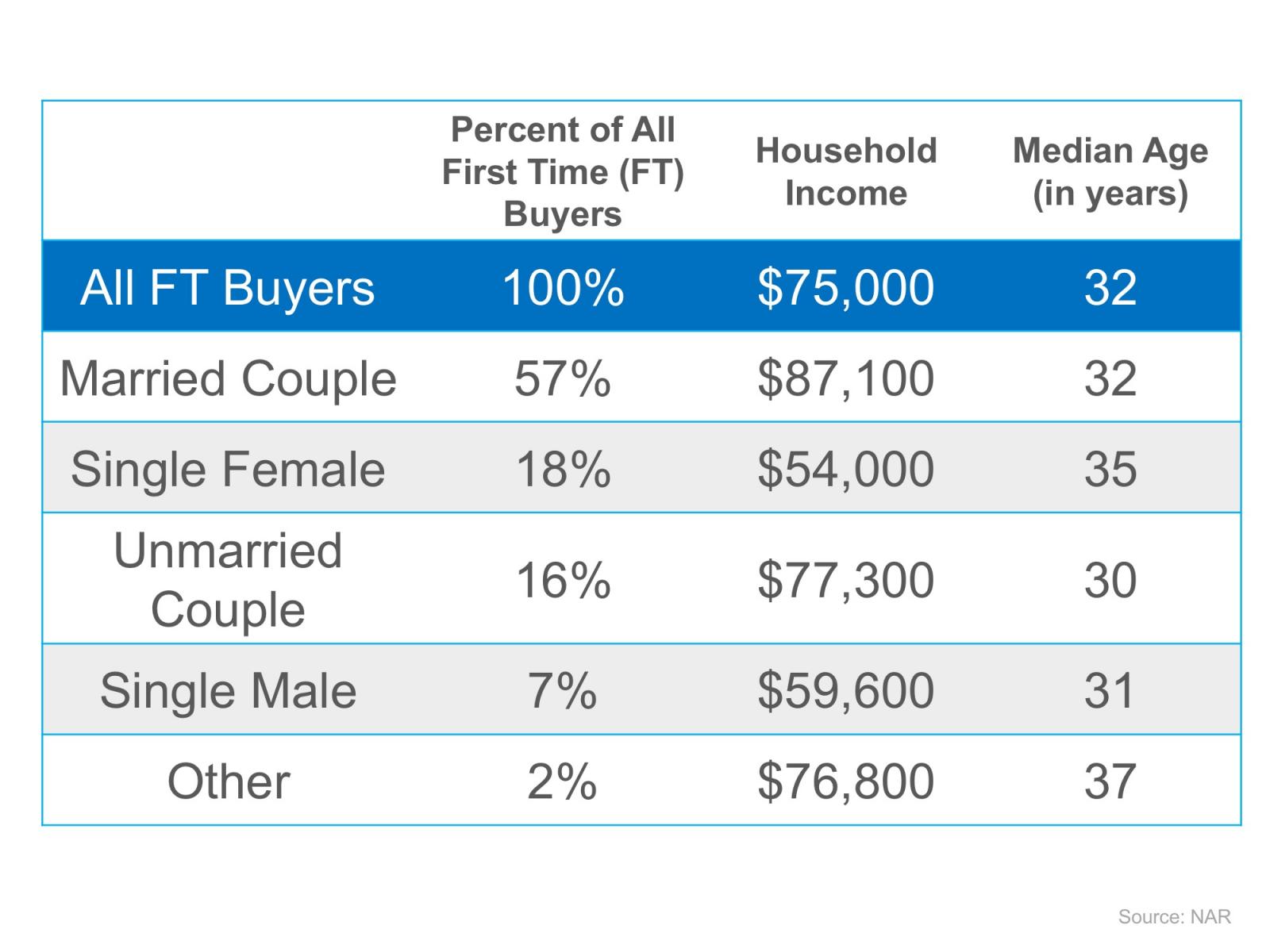

There are many people sitting on the sidelines trying to decide if they should purchase a home or sign a rental lease. Some might wonder if it makes sense to purchase a house before they are married and have a family, others might think they are too young, and still, others might think their current income would never enable them to qualify for a mortgage.

We want to share what the typical first-time homebuyer actually looks like based on the National Association of REALTORS most recent Profile of Home Buyers & Sellers. Here are some interesting revelations on the first-time buyer:

Bottom Line

You may not be much different than many people who have already purchased their first homes. Let’s meet to determine if your dream home is within your grasp.

According to the National Association of Realtors’ latest Realtors Confidence Index, 61% of first-time homebuyers purchased their homes with down payments below 6% from October 2016 through November 2017.

Many potential homebuyers believe that a 20% down payment is necessary to buy a home and have disqualified themselves without even trying. The median down payment for all buyers in 2017 was just 10% and that percentage drops to 6% for first-time buyers.

Zillow Senior Economist Aaron Terrazas’ recent comments shed light on why buyer demand has remained strong,

“Looking into 2018, rent is expected to continue gaining. More widespread rent growth could mean home buying demands stay high, as renters who can afford it move away from the unpredictability of rising rents toward the relative stability of a monthly mortgage payment instead.”

It’s no surprise that with rents rising, more and more first-time buyers are taking advantage of low-down-payment mortgage options to secure their monthly housing costs and finally attain their dream homes.

Bottom Line

If you are one of the many first-time buyers who is not sure if you would qualify for a low-down payment mortgage, contact a Greenway mortgage professional to get started on your path to homeownership!